As Filed with the Securities and Exchange Commission on May 4, 2021

Registration No. 333-255345

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Enact Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6411 | 46-1579166 | ||||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||

8325 Six Forks Road

Raleigh, North Carolina 27615

(919) 846-4100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Evan Stolove

Enact Holdings, Inc.

8325 Six Forks Road

Raleigh, North Carolina 27615

(919) 846-4100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Perry J. Shwachman Michael J. Schiavone Sean M. Carney David Ni Sidley Austin LLP One South Dearborn Chicago, Illinois 60603 Telephone: (312) 853-7000 Telecopy: (312) 853-7036 | Dwight S. Yoo Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, New York 10001 Telephone: (212) 735-3000 Telecopy: (212) 735-2000 | Evan Stolove Enact Holdings, Inc. Executive Vice President, General Counsel and Secretary 8325 Six Forks Road Raleigh, North Carolina 27615 Telephone: (919) 846-4100 Telecopy: (919) 846-4359 | Craig B. Brod Jeffrey D. Karpf Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 Telephone: (212) 225-2000 Telecopy: (212) 225-3999 | ||||||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”) check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | ||||||||

| Emerging growth company | ☒ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Shares to be Registered(1) | Proposed Maximum Offering Price(2) | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee(3) | ||||||||||

| Common Stock, par value $0.01 per share | $ | 25,962,560 | $ | 24.00 | $ | 623,101,440 | $ | 67,981.00 | ||||||

(1)Includes additional shares that the underwriters have the option to purchase to cover over-allotments.

(2) Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

(3)The Registrant previously paid $10,910 in connection with a prior filing of this Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On May 3, 2021, Enact Holdings, Inc., the registrant whose name appears on the cover of this registration statement, amended and restated its certificate of incorporation to change its name from Genworth Mortgage Holdings, Inc.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated May 4, 2021.

22,576,140 Shares

Enact Holdings, Inc.

Common Stock

This is the initial public offering of shares of our common stock. The selling stockholder named in this prospectus is offering 22,576,140 shares of our common stock. We will not be selling any shares in this offering and will not receive any proceeds from the sale of our common stock by the selling stockholder.

Prior to this offering, there has been no public market for our common stock. We expect the initial public offering price to be between $20.00 and $24.00 per share. We have applied to list our common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “ACT.”

After giving effect to this offering, Genworth Financial, Inc. (“Parent”), the parent of our direct parent and the selling stockholder in this offering, Genworth Holdings, Inc. (“GHI” or the “selling stockholder”), and our ultimate controlling entity, will continue to own, through GHI, more than a majority of the total voting power of our common stock. Accordingly, we will be a “controlled company” within the meaning of the Nasdaq rules.

Certain investment vehicles managed by Bayview Asset Management, LLC (“Bayview”) have agreed to purchase 4,000,000 shares of our common stock from the selling stockholder at a price per share equal to the initial public offering price per share less the underwriting discount per share set forth in the table below in a private placement (the “Concurrent Private Placement”). The Concurrent Private Placement is expected to close immediately following the closing of this offering and is subject to customary closing conditions, including the completion of this offering at a price per share within the range set forth above.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and under applicable Securities and Exchange Commission (the “SEC”) rules and, have elected to comply with certain reduced public company reporting requirements for this prospectus.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 24 of this prospectus.

Neither the SEC nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Share | Total | ||||||||||

Initial public offering price | $ | $ | |||||||||

Underwriting discount (1) | $ | $ | |||||||||

Proceeds, before expenses, to the selling stockholder | $ | $ | |||||||||

______________

(1)See “Underwriting” for a detailed description of compensation payable to the underwriters.

The selling stockholder has granted the underwriters an option to purchase, within 30 days of the date of this prospectus, up to 3,386,420 additional shares, at the public offering price, less the underwriting discount.

At our request, the underwriters have reserved up to 1,128,807 shares of the common stock for sale at the public offering price to certain of our and our Parent’s directors, officers and key employees through a directed share program. See “Underwriting—Directed Share Program.”

The shares will be ready for delivery on or about , 2021.

Lead Book-Running Managers

| J.P. Morgan | Goldman Sachs & Co. LLC | ||||

| Joint Book-Running Managers | |||||

| BofA Securities | Credit Suisse | ||||

| Co-Managers | ||||||||||||||

| Citigroup | Deutsche Bank Securities | Keefe, Bruyette & Woods | BTIG | Dowling & Partners Securities LLC | ||||||||||

| A Stifel Company | ||||||||||||||

The date of this prospectus is , 2021.

TABLE OF CONTENTS

Page | |||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. None of we, the selling stockholder or the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the common stock offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume the information contained in this prospectus and any free writing prospectus we authorize to be delivered to you is accurate only as of the date or dates specified in those documents. Our business, results of operations or financial condition may have changed since those dates.

For investors outside the United States: None of we, the selling stockholder or the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States.

i

Unless otherwise indicated, all references in this prospectus to the number and percentages of common stock:

•reflect the initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus;

•reflects the recapitalization and exchange of our existing common stock, par value $0.01, whereby the selling stockholder exchanged the 100 shares of common stock owned by it, representing all of our issued and outstanding capital stock, in exchange for 162,840,000 newly-issued shares of common stock, par value $0.01 (the “Share Exchange”), which was effectuated on May 3, 2021; and

•assume no exercise of the underwriters’ option to purchase up to 3,386,420 additional shares of common stock to cover over-allotments.

ii

INDUSTRY AND MARKET DATA

We obtained the industry, market and competitive position data throughout this prospectus from (i) our own internal estimates and research, (ii) industry and general publications and research, (iii) studies and surveys conducted by third parties and (iv) other publicly available information. Independent research reports and industry publications generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that the information included in this prospectus from such publications, research, studies, and surveys is reliable, neither we, the selling stockholder nor the underwriters have independently verified data from these third-party sources. In addition, while we believe our internal estimates and research are reliable and the definitions of our market and industry are appropriate, neither such estimates and research nor such definitions have been verified by any independent source. Furthermore, certain reports, research and publications from which we have obtained industry and market data that are used in this prospectus had been published before the outbreak of the coronavirus pandemic (“COVID-19”) and therefore do not reflect any impact of COVID-19 or actions or inactions by any governmental entity or private party resulting therefrom on any specific market or globally. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties as the other forward-looking statements in this prospectus.

iii

BASIS OF PRESENTATION AND NON-GAAP MEASURES

Historical Financial Statements

This prospectus includes our audited consolidated financial statements and related notes for the years ended December 31, 2020 and December 31, 2019. These financial statements are presented on the basis of United States generally accepted accounting principles (“U.S. GAAP”). The consolidated financial statements include the accounts of Enact Holdings, Inc. (“EHI”), its subsidiaries and those entities required to be consolidated under U.S. GAAP. EHI has been a wholly owned subsidiary of the Parent since its incorporation in Delaware in 2012. On November 29, 2019, the Parent completed a holding company reorganization whereby the Parent contributed 100% of the issued and outstanding voting securities of EHI to GHI. Post-contribution, EHI is a direct, wholly owned subsidiary of GHI, and GHI is still a direct, wholly owned subsidiary of the Parent.

These consolidated financial statements and related notes have been prepared on a standalone basis and were derived from the consolidated financial statements and accounting records of our Parent. The consolidated financial statements include our assets, liabilities, revenues, expenses and cash flows. All intercompany transactions and balances have been eliminated.

The consolidated financial statements include allocations of certain of our Parent’s expenses. We believe the assumptions and methodologies underlying the allocation of these expenses are reasonable. The allocated expenses relate to various services that have historically been provided to us by our Parent, including investment management, information technology services and certain administrative services (such as finance, human resources, employee benefit administration and legal). These allocations were made on a direct usage basis when identifiable, with the remainder allocated on the basis of equity, proportional effort or other relevant measures. See Note 11 to our audited consolidated financial statements for further information regarding the allocation of certain of our Parent’s expenses.

Fiscal Period

We operate on a fiscal year ending December 31 of each year.

Non-GAAP Financial Measures

In addition to our U.S. GAAP operating results, we use adjusted operating income as a performance measure when planning, monitoring and evaluating our performance. Adjusted operating income is a non-U.S. GAAP (“non-GAAP”) financial measure, and we find it to be a useful metric for management and investors to facilitate operating performance comparisons from period-to-period by excluding differences caused by our net investment gains (losses) and changes in the fair value of our previously held investment in Genworth MI Canada Inc. (“Genworth Canada”). While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for net income recognized in accordance with U.S. GAAP or other measures of profitability. We believe that this non-GAAP financial measure reflects our ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of trends in our business in conjunction with such data. In addition, other companies, including our peers, may calculate similar non-GAAP financial measures, such as adjusted operating income differently, reducing their usefulness as comparative measures between companies.

In reporting non-GAAP financial measures in the future, we may make other adjustments for expenses and gains we do not consider reflective of core operating performance in a particular period. After this offering, we may disclose other non-GAAP financial measures if we believe that such a presentation would be helpful for investors to evaluate our operating and financial condition by including additional information. For further information, please see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Use of Non-GAAP Financial Measures.”

iv

TRADEMARKS AND TRADE NAMES

On May 3, 2021, Genworth Mortgage Holdings, Inc. amended and restated its certificate of incorporation to change its name to Enact Holdings, Inc.

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. Our name, logo and registered domain names are our proprietary service marks or trademarks. Each trademark, trade name or service mark by any other company appearing in this prospectus belongs to its holder. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the SM, ©, ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, service marks, trade names and copyrights.

v

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before making an investment decision. In particular, you should read the sections entitled “Risk Factors” beginning on page 24, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 84 and the audited consolidated financial statements and notes thereto for the years ended December 31, 2020 and 2019 and other financial information included elsewhere in this prospectus. As used in this prospectus, unless the context otherwise indicates, any reference to “our company,” “the company,” “us,” “we” and “our” refers to EHI together with our consolidated subsidiaries.

Unless otherwise indicated, the information included in this prospectus assumes (1) the sale of our common stock in this offering at the initial public offering price of $22.00 per share of common stock, which is the midpoint of the price range set forth on the cover of this prospectus, (2) reflects the recapitalization and exchange of our existing common stock, par value $0.01, whereby the selling stockholder exchanged the 100 shares of common stock owned by it, representing all of our issued and outstanding capital stock, in exchange for 162,840,000 newly-issued shares of common stock, par value $0.01, and which was effectuated on May 3, 2021 and (3) that the underwriters have not exercised their option to purchase up to 3,386,420 additional shares of common stock.

In this prospectus, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect management’s view of our prospects and are subject to the risks described under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements and Market Data” in this prospectus. Our expectations of our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate.

Overview

We are a leading private mortgage insurance company serving the United States housing finance market since 1981 with a mission to help people buy a house and keep it their home. We operate in all 50 states and the District of Columbia and have a leading platform based on long-tenured customer relationships with mortgage lenders, underwriting excellence and prudent risk and capital management practices. We believe our operating and technological capabilities ensure a superior customer experience and drive new business volume at attractive risk-adjusted returns. For the full years ended December 31, 2020, 2019, 2018, 2017 and 2016 we generated new insurance written (“NIW”) of $99.9 billion, $62.4 billion, $40.0 billion, $38.9 billion and $42.7 billion, respectively. Our market share for the same periods was approximately 16.6%, 16.3%, 13.7%, 14.5% and 15.9%, respectively, having grown from 12.0% in 2012. Net income was $370 million and $678 million in 2020 and 2019, respectively. Adjusted operating income was $373 million and $562 million for 2020 and 2019, respectively. Our 2020 results of operations were impacted by increased loss reserves related to COVID-19.

As a private mortgage insurer, we play a critical role in the United States housing finance system. We provide credit protection to mortgage lenders and investors, covering a portion of the unpaid principal balance of mortgage loans where the loan amount exceeds 80% of the value of the home (“Low-Down Payment Loans”). Our credit protection frequently provides families access to homeownership sooner than would otherwise be possible. We facilitate the sale of mortgages to the secondary market, including to the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac,” and together with Fannie Mae, the government sponsored enterprises, or “GSEs”) and private investors, and protect the balance sheets of mortgage lenders that retain mortgages in their portfolios. Credit protection and liquidity through secondary market sales allow mortgage lenders to increase their lending capacity, manage risk and expand financing access to prospective homeowners, many of whom are first time homebuyers (“FTHBs”).

1

We have a large and diverse customer base. As a result of our long-standing presence in the industry, we have built and maintained enduring relationships across the mortgage origination market, including with national banks, non-bank mortgage lenders, local mortgage bankers, community banks and credit unions. In both 2019 and 2020, we provided new insurance coverage to approximately 1,800 customers, including 19 of the top 20 mortgage lenders as measured by total 2019 and 2020 mortgage originations (according to Inside Mortgage Finance).

We have a rigorous approach to writing new insurance risk based on decades of loan-level data and experience in the mortgage insurance industry. We believe we have a strong balance sheet that is well capitalized to manage through macroeconomic uncertainty and maintain compliance with the GSEs’ capital and operational standards known as the Private Mortgage Insurance Eligibility Requirements (“PMIERs”), and state regulatory standards compliance. We have enhanced our balance sheet in recent years as we transformed our business model from a “buy and hold” strategy to an “acquire, manage and distribute” approach through our credit risk transfer (“CRT”) program. We utilize our CRT program to mitigate future loss volatility and drive efficient capital management. Our CRT program is a material component of our strategy and we believe it helps to protect future business performance and stockholder capital under stress scenarios by transferring risk from our balance sheet to highly-rated counterparties or to investors through collateralized transactions. As of December 31, 2020, we had a published PMIERs sufficiency ratio of 137%, representing $1,229 million of available assets above the published PMIERs requirement and approximately 94% of our insured portfolio was covered by our CRT program. Our PMIERs sufficiency ratio, which is based on the published requirements applicable to private mortgage insurers, was above the requirement imposed by the GSE Restrictions (as defined below) that required us to maintain a PMIERs sufficiency ratio of 115% in 2020.

Market Opportunities

The demand for mortgage insurance is strong and has remained resilient even in the face of the COVID-19 pandemic providing us with significant continued opportunities to write attractive, profitable new business. Record low interest rates and strong underlying demographics have provided tailwinds to the overall housing market, resulting in record levels of NIW. Certain positive trends, such as a growing FTHB population and accommodative monetary policy were observed even prior to the COVID-19 pandemic, and we expect them to persist. Throughout 2020 and continuing in early 2021, the immediate and sizeable application of government stimulus and forbearance availability along with other government programs have provided key support to the housing market throughout the COVID-19 pandemic. For the full year 2020, industry NIW was $600 billion, up 56% compared with the full year 2019.

In addition to the benefits from the strong demand for mortgage insurance, over the last decade, regulatory reforms and new industry practices have significantly improved the mortgage insurance industry’s risk profile. Further, insured loans have experienced rising home prices since the third quarter of 2011, thus increasing borrower equity and improving the risk profile since origination. The quality of new mortgages originated in the United States and insured by the mortgage insurance industry over the last decade is of significantly higher credit quality than in the prior decade, and we believe the industry’s use of CRT alternatives will reduce loss volatility when stress defaults emerge. Additionally, the industry has shifted towards granular risk-based pricing models and new business has been priced at attractive risk-adjusted rates. We believe that we are well-positioned to benefit from these continuing trends and will be able to write a significant volume of highly attractive new business.

•Resilient housing market. We believe that recent data supports continued optimism in the resilience of the United States housing market that has resulted in recent record levels of industry NIW:

◦Affordability and interest rates: Housing affordability promotes new mortgage originations and growing homeownership rates, particularly among FTHBs, which is a positive for our new business volumes. Rates for 30- year mortgages fell by just over two percentage points from the end of 2018 to the fourth quarter of 2020. Interest rates decreased over the course of

2

2020, as average rates on 30-year mortgages fell to 2.76% in the fourth quarter of 2020 from 3.52% in the first quarter of 2020. The National Association of Realtors Housing Affordability Index, which measures the ability of the median income homebuyer to make mortgage payments on the median-priced United States home, increased to 170 in December 2020 from 158 in 2017. The 30-year mortgage rate has increased to above 3% more recently according to Inside Mortgage Finance, but remains at historically low levels.

◦Housing prices: Housing prices in the United States have remained resilient through the COVID-19 pandemic, which has helped maintain strong consumer confidence in the housing market. Housing prices nationally increased 11.4% year-over-year in December 2020 according to the Federal Housing Finance Agency (“FHFA”) House Price Index for home purchase loans, illustrating the continued strength and resiliency of the housing market. Among other drivers, housing prices have been supported by an ongoing low supply of homes for sale in many parts of the country.

◦Demographics: Four to five million Americans per year are expected to reach the median FTHB age between 2020 and 2021, which is 33 years old according to the National Association of Realtors 2019 Buyer and Seller Survey. The rate at which FTHBs are entering the housing market is expected to drive an increased demand for homeownership relative to historical periods, as the number of projected new entrants to the FTHB population in 2021 is approximately 13% higher than the comparable figure in 2011 according to the United States Census Bureau. During 2020, FTHBs purchased 2.4 million homes, 14% more than in 2019. The fourth quarter of 2020 saw approximately 657,000 homes purchased by FTHBs, up 26% compared to the fourth quarter of 2019. During the fourth quarter of 2020, the percentage of home sales to FTHBs was 40%, an increase of 0.3 percentage points from the third quarter. The rate of homeownership showed a seasonal decline in the fourth quarter of 2020 to 65.8% but remained 0.7 percentage points higher than the same period in 2019. We expect these demographic forces to remain strong as the COVID-19 pandemic is an additional driver for demand in homeownership in an environment that has become more accepting of work-from-home arrangements.

◦New mortgage originations: Despite macroeconomic uncertainties related to the COVID-19 pandemic, purchase applications were 11% higher for 2020 compared to 2019 and experienced year-over-year gains every week starting from June, according to the Mortgage Bankers Association (“MBA”). Purchase applications were 24% higher for the fourth quarter of 2020 compared to the same quarter in 2019.

◦Given the current economic environment, the MBA projects that purchase originations will continue to grow from $1.4 trillion in 2020 to approximately $1.6 trillion for 2022, while Fannie Mae expects $1.8 trillion in purchase originations in 2022.

◦Forbearance: As a result of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) and other government and GSE policies enacted in response to the COVID-19 pandemic, borrowers broadly have had access to forbearance and foreclosure moratoria programs that allow borrowers to remain in their homes and delay principal and interest payments for up to 18 months. We believe that these programs have contributed to the positive trends in the housing market as they allow many borrowers to navigate the current crisis, remain in their homes, subsequently become current on their mortgages as the economy improves and ultimately resume making regular mortgage payments. Given that mortgage insurance claims are not paid until after foreclosure proceedings conclude, resumption of payments by borrowers would reduce our actual loss exposure. In the wake of the COVID-19 pandemic, forbearance rates peaked at 7.1% as of May 26, 2020 and have since steadily declined according to data provided by Black Knight Inc. (“Black Knight”). As of March 9, 2021, 3.1% of all GSE mortgages were in forbearance according to Black Knight.

3

•Sustained strong credit quality within the United States housing system. The high-quality nature of underlying mortgages in recent years is the result of improved risk analytics, stronger loan manufacturing quality controls, risk-based capital (“RBC”) rules and the regulatory implementation of the Qualified Mortgage (“QM”) provisions. Additionally, changes within the private mortgage insurance industry such as PMIERs operational requirements and the adoption of more granular risk-based pricing models have enabled the private mortgage insurance industry to underwrite the risks they accept in their insurance portfolio based on more granular data. Over the past decade, the average Fair Isaac Corporation (“FICO”) score on all mortgage loans originated in the United States and sold to the GSEs was 752, compared to 718 for the period from 2005 through 2008, based on data from the GSEs. As a result, we believe the industry is insuring loans from borrowers who should be better positioned to meet their mortgage obligations, which should translate into fewer claims for the mortgage insurance industry. Additionally, the credit quality of new business written since the onset of COVID-19 has remained strong. The industry’s NIW mix of above-740 FICO borrowers held constant at 63% to 65% throughout 2020. Similarly, the mix of below-680 FICO borrowers remained constant at 4% throughout 2020.

•The increasing availability and attractiveness of risk transfer alternatives has improved the industry’s risk profile. Since 2015, private mortgage insurers have used CRT alternatives to reinsure or otherwise transfer risk to third parties. The industry uses both traditional reinsurance as well as mortgage insurance-linked notes (“MILNs”). According to U.S. Mortgage Insurers, as of October 2020 private mortgage insurers have transferred approximately $29 billion of risk to traditional reinsurers through quota share (“QS”) and excess-of-loss (“XOL”) transactions and transferred almost $12.3 billion of risk to the capital markets through MILN transactions since 2015.

Private mortgage insurers have generally utilized CRT as both a capital management tool and a programmatic approach to mitigate future loss volatility and they have transformed from a “buy and hold” strategy to an “acquire, manage and distribute” approach. We believe that the adoption of these practices in the industry will reduce the capital and loss volatility that historically impacted the sector during economic downturns, at an attractive cost, generating higher returns through the cycle for the industry.

•Strong private mortgage insurance penetration in the insured purchase mortgage market. Private mortgage insurance has increased penetration as a result of the introduction of new GSE products designed to serve Low-Down Payment Loan borrowers and more competitive pricing by private mortgage insurers relative to the Federal Housing Administration (“FHA”). In 2020, the FHA insured 26% of all new Low-Down Payment Loan originations with private mortgage insurance insuring 52%. Also, in 2018 and 2019, private mortgage insurance helped to finance more FTHBs than the FHA. We believe there may be additional opportunities for private mortgage insurers to increase market share by providing risk and capital relief for lender portfolios and loans supporting private mortgage-backed securities (“MBS”).

Our Strengths

We believe that the following competitive strengths have supported our success to-date and provide a strong foundation for our future financial performance:

•Well-established, diversified customer relationships driven by our differentiated value proposition. We have long-standing and enduring relationships with approximately 1,800 active customers across the mortgage origination market, including with national banks, non-bank mortgage lenders, local mortgage bankers, community banks and credit unions. Approximately 92% of our NIW in 2020 was from customers who have submitted loans to us every year since 2016.

4

•We offer competitive pricing combined with targeted services that distinguish us from our competitors. We reach our customers through our dynamic sales model, which combines high-touch, in-person customer visits with more scalable tele-sales and digital marketing methods. Our approach allows us to offer our products, tools, and solutions effectively and efficiently, providing a superior customer experience, including:

◦Best-in-class underwriting platform: We believe our investments in technology, service and training have distinguished our underwriting services. We were the first mortgage insurer to broadly introduce service level commitments to meet customer needs for expedited underwriting services, and we continue to innovate through differentiated offerings that drive both an excellent customer experience and improved efficiency for us. Our scalable underwriting platform has a proven ability to handle spikes in volume while continuing to achieve customer service level expectations. In a blind survey of mortgage lenders conducted by Knowledge Systems & Research, Inc. (“KS&R”), we were rated as “best-in-class” for mortgage insurance underwriting in 2016, 2017 and 2018, the last three years in which the survey was conducted.

◦Customer ease-of-use: Our online tools integrate with all leading mortgage technology platforms, allowing our customers to select our products directly within their own system architecture, creating a more efficient way to choose and use our products. In addition, we maintain an award-winning ordering and rate quote website.

◦Customer growth support: We support our customers’ growth objectives with a wide variety of training programs. We also provide unique offerings, including strategy and process consulting services and differentiated borrower-centric products.

•Large portfolio of insurance in-force. As of December 31, 2020, we had $208 billion insurance in-force (“IIF”) as compared to $182 billion as of December 31, 2019. Since January 1, 2019, we have generated $162 billion of NIW with an average market share of 16.5% and have grown our IIF 32% over the same time period. The growth in our IIF has resulted in premiums earned growing from $857 million for the twelve months ended December 31, 2019 to $971 million for the twelve months ended December 31, 2020. We believe our portfolio has significant embedded value potential and creates a strong foundation for future premiums.

•Risk analytics and underwriting drive strong underlying credit quality of insurance portfolio. We believe we have a very strong approach to onboarding risk backed by decades of loan-level performance data and experience in the mortgage insurance industry. We ensure that the underlying credit quality of our insured mortgage portfolio meets our risk and profitability framework. In order to underwrite new policies, we utilize a proprietary risk analytics model, One Analytical Framework, to target loans within our risk appetite with an appropriate price. This framework leverages our unique data set, which contains decades of mortgage performance across various market conditions to develop quantitative assessments of the probability of default, severity of loss and expected volatility on each insured loan. Additionally, all loans pass through our eligibility rules engine to screen out those loans that fall outside of our guidelines.

We perform rigorous analytics to evaluate the risk characteristics of our portfolio. We analyze the cumulative layered risks, which includes factors like the loan-to-value (“LTV”), FICO, debt-to-income ratio (“DTI Ratio”) and occupancy type, in each loan. Our models can assess the effect of such layered risks and the weight of each risk factor to determine the volatility of losses. The information is used to drive our risk appetite and pricing at a loan level. For example, we actively manage the number of loans with LTV greater than 95% that also have FICO scores of less than 680 (“High-Risk Loans”) and have additional high risk layers, including single borrower, DTI Ratio of greater than 45%, cash-out refinances or are investor-owned properties (each a “Risk Layer,” and collectively, “Risk Layers”). Among our High-Risk Loans as of December 31, 2020, none of our risk in-force (“RIF”) had three or more Risk Layers, 0.3% of our RIF had two Risk Layers,

5

1.0% of our RIF had one Risk Layer and 0.8% of our RIF had no Risk Layers. For our NIW for the year ended December 31, 2020, none of our High-Risk Loans had two or three Risk Layers, .04% of our High-Risk Loans had one Risk Layer and .03% of our High-Risk Loans had no Risk Layers.

The equity position of many borrowers in our portfolio provides additional strength and may support fewer borrowers defaulting and resulting in a mortgage insurance claim. As of March 31, 2021 and December 31, 2020, respectively, approximately 90% and 86% of our delinquent policies-in-force (“PIFs”) and 79% and 75% of all PIFs have a mark to market LTV of less than or equal to 90%. For the same periods, approximately 56% and 52% of our delinquent PIFs and 38% of all PIFs have a mark to market LTV of less than or equal to 80%. With so many borrowers having significant equity in their home, we believe this provides an additional risk mitigant as borrowers will work to maintain their equity and avoid foreclosure.

•Comprehensive risk management and CRT philosophy. Beyond our approach for underwriting and onboarding a portfolio that aligns with our risk appetite, we also conduct quarterly stress testing on the portfolio to determine the impact of various stress events on our performance. The result of those tests and our desire to reduce loss volatility and protect our capitalization inform our CRT strategy.

◦Our CRT strategy is designed to reduce the loss volatility of our portfolio during stress scenarios by transferring risk from our balance sheet to highly-rated counterparties or to investors through collateralized transactions. Additionally, in normal market conditions, we believe our CRT program enhances our return profile. We customize our CRT transactions based on a variety of factors including, but not limited to, capacity, cost, flexibility, sustainability and diversification.

◦Since 2015, we have executed CRT transactions on $2.5 billion of RIF across both traditional reinsurance arrangements and MILN transactions through December 31, 2020. We believe that our ability to access both markets allows us to optimize cost of capital, provides counterparty diversification and minimizes warehousing risk through the use of forward commitments with traditional reinsurance partners.

◦As of December 31, 2020, 94% of our RIF is covered under our current CRT program, and we estimate our book year reinsurance transactions generally begin transferring losses at an approximate 30% to 35% lifetime book year loss ratio and extend up to an approximate 60% to 70% lifetime book year loss ratio at current pricing assumptions and depending on our co-participation level within the reinsurance tier. As of December 31, 2020, we maintain $1.4 billion of reinsurance protection outstanding on our 2009 to 2020 book years, providing $936 million of PMIERs capital support, which does not include the $495 million transaction with Triangle Re 2021-1 Ltd. (“Triangle Re 2021-1”) completed on March 2, 2021 or the $303 million transaction with Triangle Re 2021-2 Ltd. (“Triangle Re 2021-2”) completed on April 16, 2021. See “Business—Credit Risk Transfer.” We plan to continue to utilize CRT transactions to effectively manage our through-the-cycle risk and return profile.

•Strong capitalization driven by prudently managed balance sheet. We are a strongly capitalized counterparty. As of December 31, 2020, we had total U.S. GAAP stockholder equity of $3.9 billion and a PMIERs sufficiency ratio of 137%, representing $1,229 million of available assets above the published PMIERs requirements. The PMIERs sufficiency ratio is based on the published requirements applicable to private mortgage insurers and does not give effect to the GSE Restrictions. Our mortgage insurance subsidiaries had total statutory capital and surplus of $4.0 billion as of December 31, 2020. Our combined statutory risk-to-capital (“RTC”) ratio at the same date was 12.1:1, well below the North Carolina Department of Insurance (“NCDOI”) regulatory maximum of 25:1.

6

•Dynamic leadership team with through-the-cycle experience and a proven track record of delivering results. Our executive leadership team has significant experience in mortgage insurance and housing finance, with a proven track record of risk management, financial success and leadership through-the-cycle.

◦Our executive management team has an average of 27 years of relevant industry experience, and an average tenure in the mortgage insurance industry of 14 years.

◦Our team has executed through-the-cycle while facing multiple headwinds, including macroeconomic conditions, changing capital regimes, ratings disparity to competitors and challenges faced by our Parent.

◦Our intentional focus on reinforcing, recognizing and rewarding our values of Excellence, Improvement and Connection has driven high employee engagement and has been recognized externally at both the local and industry levels, including the Triangle Business Journal Best Places to Work and MBA Diversity & Inclusion award programs.

◦We believe our executive management team has the right combination of client-facing, underwriting, risk and leadership skills necessary to drive our long-term success.

Our Strategy

Our objective is to leverage our competitive strengths to maximize value for our stockholders by driving profitable market share, maintaining our strong capital levels and earnings profile and delivering attractive risk-adjusted returns:

•Continue to write profitable new business. Over the course of the past year, since the onset of the COVID-19 pandemic, we wrote significant NIW of higher-credit quality and at higher pricing. We now believe that the resilience of the housing market, which is supported by historically low interest rates and strong underlying demographics, will continue to provide a positive backdrop for us to maintain writing new business at an attractive return.

•Protect our balance sheet by maintaining strong capital levels, robust underwriting standards and prudently managing risk. We understand the importance of our balance sheet strength to our customers and intend to continue to serve as a high-quality counterparty. We use One Analytical Framework to evaluate returns and volatility, applying both an external regulatory lens and an economic capital framework that is sensitive to current housing market cycles relative to historical trends. The results of these analyses inform our risk appetite, credit policy and targeted risk selection strategies, which we primarily implement through our proprietary pricing engine, GenRATE. We work to protect future business performance and stockholder capital under stress scenarios with a programmatic CRT program, including traditional XOL reinsurance and MILNs. Our CRT program has helped transform our business model from a “buy and hold” strategy to an “acquire, manage and distribute” approach. We believe the comprehensive rigor of our underwriting and risk management policies and procedures allows us to prudently manage and protect our balance sheet.

•Maintain existing relationships and develop new relationships by driving differentiated value and experience. We offer our customers a unique value proposition and an experience tailored to their needs, with expedited, quality underwriting and fair and transparent claims handling practices. Our dynamic sales model serves customers from all segments, including high-touch national accounts, regional accounts where a localized presence is necessary and a scalable tele-sales model to efficiently reach our full suite of customers. We intend to leverage our strengths in these areas to continue serving our existing customer base while also establishing new relationships.

7

•Strategically invest in technologies and capabilities to drive operational excellence across our business. Our investments in underwriting, risk management, data analytics and customer technology have both optimized our business and improved our customers’ experience. We plan to continue to invest in solutions that keep us at the forefront of technological advancements, fostering efficiency and helping to secure new customers.

•Prudent capital management to maximize stockholder value. Our capital management approach is to maximize value to our stockholders by prioritizing the use of our capital to (i) support our existing policyholders; (ii) grow our mortgage insurance business; (iii) fund attractive new business opportunities; and (iv) return capital to stockholders. When evaluating a potential return of capital to stockholders, we prudently evaluate the prevailing and future macroeconomic conditions, business performance and trends, regulatory requirements, any applicable contractual or similar restrictions and PMIERs sufficiency. Given our current views of the regulatory and macroeconomic environment, including the decline of forbearance related activity, management intends to seek regulatory and board approval to initiate the return of excess capital, including the initiation of a regular common dividend as soon as 2022. Any future dividend determination will be made by our board, and will be subject to a number of factors described under “Dividend Policy” below.

•Continue to remain engaged with the regulatory landscape and promote the importance of the private mortgage insurance industry. We believe the private mortgage insurance industry plays a critical role in the success of the United States housing market. We have a government and industry affairs team who play a leadership role across the mortgage insurance industry to monitor the landscape and stay apprised of new and potential developments that could impact mortgage insurance. We have strong relationships with the GSEs, the key federal government agencies and various other regulatory bodies and industry associations who are important to the housing ecosystem and we actively work to provide input on outcomes of key legislation and regulation. We also maintain consistent dialogue with state insurance regulators. We intend to continue to support the role of a stable and competitive private mortgage insurance industry and a well-functioning United States housing finance system.

Our Parent and Principal Stockholder

Our Parent currently owns all of the shares of our common stock indirectly through GHI. GHI, the sole selling stockholder in this offering, is selling 22,576,140 shares (or 25,962,560 shares if the underwriters exercise in full their option to purchase additional shares) of our common stock in this offering. Following this offering, our Parent will own approximately 83.7% (or approximately 81.6% if the underwriters exercise in full their option to purchase additional shares) of our outstanding common stock indirectly through GHI. Our Parent will therefore control a majority of the total voting power of our common stock. As a result, our Parent generally will be able to determine the outcome of corporate actions requiring majority stockholder approval, including, for example, the election of directors and the amendment of our certificate of incorporation and bylaws. Our Parent may also have interests that differ from yours and may vote in a way with which you disagree and which may be adverse to your interests. In addition, we will be a “controlled company” within the meaning of the Nasdaq rules, and intend to rely on certain “controlled company” exemptions from certain corporate governance requirements. For additional information regarding the exemptions on which we intend to rely, see “Management—Controlled Company” and “Risk Factors—General Risk Factors—We will be a ‘controlled company’ within the meaning of the Nasdaq rules and we will qualify for exemptions from certain corporate governance requirements.” For additional information regarding our Parent’s ability to control the outcome of matters put to a stockholder vote and potential conflicts of interest, see “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—Our Parent will be able to exert significant influence over us and our corporate decisions.” and “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—Conflicts of interest and other disputes may arise between our Parent and us that may be resolved in a manner unfavorable to us and our other stockholders.”

8

In connection with this offering, we and our Parent and certain of our Parent’s other subsidiaries intend to enter into agreements that will provide a framework for our ongoing relationship with our Parent. For example, following this offering and for so long as our Parent continues to beneficially own 50% or more of our outstanding common stock, our Parent will have the right to nominate the majority of our directors. For additional information regarding these agreements, see “Certain Relationships and Related Party Transactions—Relationship with Our Parent.”

We depend on our Parent for certain services and are exposed to certain risks as a result of our relationship with our Parent. Our Parent also has substantial leverage, depends on us as a source of liquidity and is subject to the GSE Conditions (as defined below) which impose restrictions on our use of capital. However, we believe a potential benefit of this offering is the possibility of an improvement in the ratings assigned to us by one or more nationally recognized ratings agencies. See “Risk Factors—Risks Relating to Our Business—Adverse rating agency actions have resulted in a loss of business and adversely affected our business, results of operations and financial conditions, and future adverse rating agency actions could have a further and more significant impact on us,” “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—Our reputation and ratings could be affected by issues affecting our Parent in a way that could materially adversely affect our business, financial condition, liquidity and prospects,” “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—Our Parent’s indebtedness and potential liquidity constraints may negatively affect us,” “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—The AXA Settlement may negatively affect our ability to finance our business with additional debt, equity or other strategic transactions” and “Risk Factors—Risks Relating to Our Business—If we are unable to continue to meet the requirements mandated by PMIERs, the GSE Restrictions and any additional restrictions imposed on us by the GSEs, whether because the GSEs amend them or the GSEs’ interpretation of the financial requirements requires us to hold amounts of capital that are higher than we have planned or otherwise, we may not be eligible to write new insurance on loans acquired by the GSEs, which would have a material adverse effect on our business, results of operations and financial condition.”

In addition to us, our Parent owns an international mortgage insurance business located in Mexico and has a minority investment in a mortgage guarantee business in India, each separate from our business. In April 2021, we entered into an agreement to purchase our Parent’s minority ownership interest in the mortgage guarantee business in India for a cash purchase price that is not material to us. The closing of the transaction is subject to customary closing conditions, including receipt of any required regulatory approvals. Our Parent also owns other insurance subsidiaries that provide long-term care and life insurance in the United States.

Concurrent Private Placement

We and the selling stockholder have entered into a stock purchase agreement with Bayview, pursuant to which Bayview has agreed to purchase 4,000,000 shares of our common stock from the selling stockholder at a price per share equal to the initial public offering price per share less the underwriting discount per share set forth on the cover page of this prospectus in the Concurrent Private Placement. The Concurrent Private Placement is expected to close immediately following the closing of this offering and is subject to customary closing conditions, including the completion of this offering at a price per share within the range set forth on the cover page of this prospectus. None of the shares of our common stock to be sold in the Concurrent Private Placement will be registered and sold in this offering. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholder in the Concurrent Private Placement.

9

Summary Risk Factors

An investment in our common stock involves numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment in our common stock. Key risks include, but are not limited to, the following:

•The COVID-19 pandemic has adversely impacted our business, and its ultimate impact on our business and financial results will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic, the resurgence of cases of the disease, the reimposition of restrictions designed to curb its spread, the effectiveness and availability of vaccines, and other actions taken by governmental authorities in response to the pandemic.

•If we are unable to continue to meet the requirements mandated by PMIERs, the GSE Restrictions and any additional restrictions imposed on us by the GSEs, whether because the GSEs amend them or the GSEs’ interpretation of the financial requirements requires us to hold amounts of capital that are higher than we have planned or otherwise, we may not be eligible to write new insurance on loans acquired by the GSEs, which would have a material adverse effect on our business, results of operations and financial condition.

•A deterioration in economic conditions or a decline in home prices may adversely affect our loss experience.

•We establish loss reserves when we are notified that an insured loan is in default, based on management’s estimate of claim rates and claim sizes, which are subject to uncertainties and are based on assumptions about certain estimation parameters that may be volatile. As a result, the actual claim payments we make may materially differ from the amount of our corresponding loss reserves.

•If the models used in our business are inaccurate or there are differences and/or variability in loss development compared to our model estimates and actuarial assumptions, it could have a material adverse effect on our business, results of operations and financial condition.

•Competition within the mortgage insurance industry could result in the loss of market share, loss of customers, lower premiums, wider credit guidelines and other changes that could have a material adverse effect on our business, results of operations and financial condition.

•Changes to the role of the GSEs or to the charters or business practices of the GSEs, including actions or decisions to decrease or discontinue the use of mortgage insurance, could adversely affect our business, results of operations and financial condition.

•The amount of mortgage insurance we write could decline significantly if alternatives to private mortgage insurance are used or lower coverage levels of mortgage insurance are selected.

•Our reliance on customer relationships could cause us to lose significant sales if one or more of those relationships terminate or are reduced.

•Our reputation and ratings could be affected by issues affecting our Parent in a way that could materially and adversely affect our business, financial condition, liquidity and prospects.

Emerging Growth Company Status

We currently qualify as an “emerging growth company” because, at the time of initial confidential submission of our registration statement, our gross revenue for the then most recently ended fiscal year (the year ended December 31, 2019) was less than $1.07 billion. Because our gross revenue for the fiscal year ended December 31, 2020 exceeded $1.07 billion, we will cease to qualify as an emerging growth company upon consummation of this offering. Because we currently qualify as an emerging

10

growth company, we are permitted to apply new accounting standards under an extended transition period available to private companies and take advantage of reduced reporting requirements in this prospectus. We have elected to apply the extended transition periods for new accounting standards applicable to private companies and reduced reporting requirements, as further described below.

An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

•we may present only two years of audited financial statements and only two years of related management discussion and analysis of financial condition and results of operations;

•we are exempt from the requirement to obtain an attestation and report from our auditors on management’s assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”);

•we are permitted to provide less extensive disclosure about our executive compensation arrangements; and

•we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements.

We have elected to take advantage of the reduced disclosure requirements and other relief described in this prospectus and may take advantage of these exemptions for so long as we remain an emerging growth company. We have elected to apply the extended transition periods for new accounting standards applicable to private companies, further described in Note 2 to our audited consolidated financial statements for the years ended December 31, 2020 and 2019.

Our Corporate Information

We are incorporated in Delaware and are an indirect wholly owned subsidiary of our Parent, a diversified insurance holding company listed on the New York Stock Exchange (“NYSE”).

Our primary operating subsidiary, Genworth Mortgage Insurance Corporation (“GMICO”), is domiciled in North Carolina, and we are headquartered in Raleigh, North Carolina.

Our principal executive offices are located at 8325 Six Forks Road, Raleigh, North Carolina 27615 and our telephone number is (919) 846-4100. Our corporate website address is https://mortgageinsurance.genworth.com/. We do not incorporate the information contained on, or accessible through, our corporate website into this prospectus, and you should not consider it a part of this prospectus. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

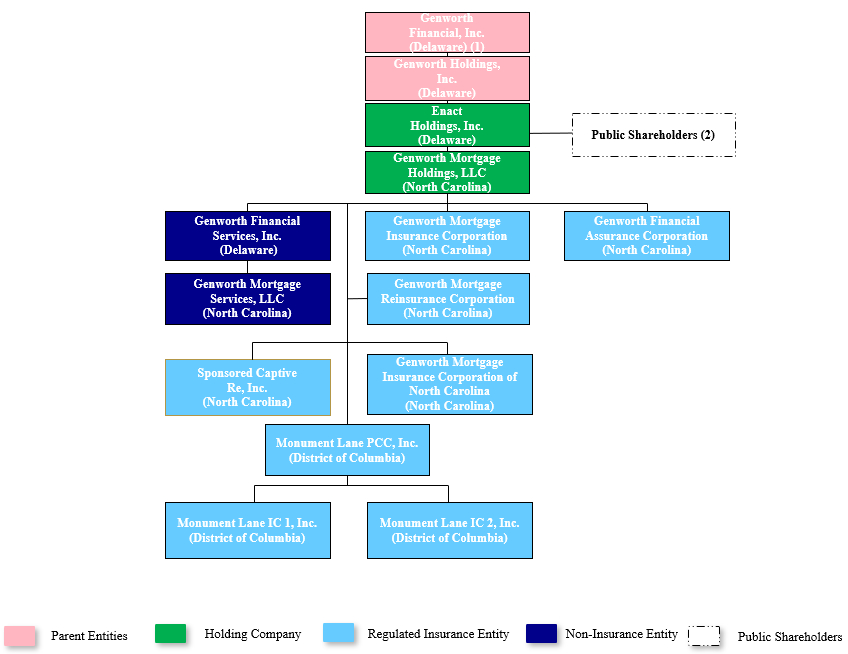

Organizational Chart

Below is a simplified and illustrative organizational chart summarizing our ownership including the ownership of our public stockholders and our Parent and the ownership of our subsidiaries following the completion of this offering and the Concurrent Private Placement. This chart also presents the jurisdiction of incorporation for each subsidiary and notes whether a subsidiary is a holding company, regulated insurance entity or non-insurance entity. The ownership of all entities in the chart below is 100% unless otherwise noted. Upon the completion of this offering and the Concurrent Private Placement, our Parent will indirectly own approximately 83.7% of our outstanding common stock (approximately 81.6% if the underwriters exercise in full their option to purchase additional shares), purchasers of shares of common stock in this offering will own approximately 13.9% of our outstanding common stock (approximately

11

15.9% if the underwriters exercise in full their option to purchase additional shares) and Bayview will own approximately 2.5% of our outstanding common stock.

_____________

(1)In connection with the AXA Settlement, our Parent entered into a Promissory Note secured by a 19.9% interest in our common stock held by our Parent. The collateral will be fully released upon full repayment of the Promissory Note and may be partially released under certain circumstances upon certain prepayments. See “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—Our Parent’s indebtedness and potential liquidity constraints may negatively affect us” and “Risk Factors—Risks Relating to Our Continuing Relationship with Our Parent—The AXA Settlement may negatively affect our ability to finance our business with additional debt, equity or other strategic transactions.”

(2)Includes 4,000,000 shares of our common stock to be sold to Bayview pursuant to the Concurrent Private Placement.

12

Recent Developments

The following condensed financial information reflects our preliminary results for the three months ended March 31, 2021, based on information currently available to management. The preliminary estimated financial results set forth below should not be viewed as a substitute for full quarterly financial statements prepared in accordance with U.S. GAAP. We will not publicly file our actual unaudited quarterly consolidated financial results for the three months ended March 31, 2021 with the SEC until after the consummation of this offering. As a result, our actual results for the three months ended March 31, 2021 may differ from the preliminary estimated financial results set forth below upon the completion of our financial quarter end closing procedures, final adjustments and other developments that may arise prior to the time our financial results are finalized, and such differences could be material. You should not place undue reliance on the following condensed financial information. In addition, the preliminary estimated financial results set forth below are not necessarily indicative of results we may achieve in any future period. Amounts set forth below are approximate.

The preliminary financial data set forth below have been prepared by, and are the responsibility of, our management and are based on a number of assumptions. Our independent registered public accounting firm, KPMG LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto. For additional information, see “Cautionary Note Regarding Forward-Looking Statements and Market Data” and “Risk Factors.”

| Other Operating Data | March 31, | ||||||||||

| ($ amounts in millions except Net Premiums Earned, Net Income, and Adjusted Operating Income amounts in thousands) | 2021 | 2020 | |||||||||

NIW (for the period ended) (1) | $ | 24,934 | $ | 17,908 | |||||||

IIF (as of) (2) | $ | 210,187 | $ | 187,981 | |||||||

RIF (as of) (3) | $ | 52,866 | $ | 47,740 | |||||||

Persistency Rate (for the period ended) (4) | 56 | % | 74 | % | |||||||

Net Premiums Earned (for the period ended) (5) | $ | 252,542 | $ | 226,198 | |||||||

Loss Ratio (for the period ended) (6) | 22 | % | 8 | % | |||||||

Expense Ratio (net earned premiums) (for the period ended) (7) | 24 | % | 25 | % | |||||||

Net Income (for the period ended) (8) | $ | 125,131 | $ | 145,265 | |||||||

Adjusted Operating Income (for the period ended) (9) | $ | 125,886 | $ | 145,190 | |||||||

PMIERs excess (as of) (10) | $ | 1,764 | $ | 1,171 | |||||||

PMIERs sufficiency ratio (as of) (11) | 159 | % | 142 | % | |||||||

Operating Leverage (12) | 30 | % | 23 | % | |||||||

Book Value (Total equity) (as of) (13) | $ | 3,935 | $ | 3,865 | |||||||

Debt-to-Capital (14) | 16 | % | 0 | % | |||||||

Return on equity (15) | 13 | % | 16 | % | |||||||

EHI Holdco Cash (16) | $ | 284 | $ | 0 | |||||||

GMICO RTC ratio (as of) (17) | 11.9 | 12.4 | |||||||||

PIF (count) (as of) (18) | 922,186 | 868,111 | |||||||||

Delinquent loans (count) (as of) (19) | 41,332 | 15,417 | |||||||||

Delinquency Rate (as of) (20) | 4.48 | % | 1.78 | % | |||||||

Forbearance Rate (as of) (21) | 4.91 | % | 0.27 | % | |||||||

______________

(1)Presents the aggregate loan balance on new primary policies written during a given period.

(2)Presents the aggregated estimated unpaid principal balance of the primary mortgages we insure at a given date. IIF represents the remaining unpaid principal balance of NIW from all prior periods less policy cancellations (including for prepayment, nonpayment of premiums and claims payment) and rescissions.

13

(3)Presents the aggregate amount of coverage we provide on primary PIF as of a given date. RIF is calculated as the sum total of coverage percentage of each individual policy in our portfolio applied to the estimated unpaid principal balance of such insured mortgage.

(4)Presents the annualized percentage of IIF for prior periods (quarter) on a primary basis that remains as of a given date.

(5)Presents the gross direct earned premiums and assumed premiums net of ceded premiums.

(6)Calculated by dividing losses incurred by net earned premiums.

(7)Calculated by dividing acquisition and operating expenses, net of deferrals, plus amortization of DAC and intangibles by net earned premiums.

(8)Represents net income on a U.S. GAAP consolidated basis.

(9)Adjusted operating income is a Non-GAAP measure. We present adjusted operating income as a supplemental measure of our performance. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Key Metrics—Use of Non-GAAP Measures” for its definition and “Basis of Presentation and Non-GAAP Measures—Non-GAAP Measures.” See below for a reconciliation of adjusted operating income to net income, the most comparable U.S. GAAP measure.

(10)Calculated as total available assets less net required assets, based on the published PMIERs then in effect.

(11)Calculated as total available assets divided by net required assets, based on the published PMIERs then in effect.

(12)Calculated by dividing PMIERs reinsurance credit by PMIERs gross required assets.

(13)Represents Total Equity on a U.S. GAAP consolidated basis.

(14)Calculated by dividing total debt outstanding by total equity plus total debt outstanding.

(15)Calculated as adjusted operating income annualized divided by the average of current quarterly fiscal period and prior year’s quarterly fiscal period ending total stockholders’ equity.

(16)Represents Cash and Cash Equivalents held at EHI.

(17)Our primary operating subsidiary, GMICO’s RTC ratio, calculated by dividing GMICO’s statutory RIF by its statutory capital (insurer’s policyholders’ surplus plus the statutory contingency reserves).

(18)Presents the number of primary policies we insure as of the dates indicated.

(19)Presents on a primary basis the total delinquent loans reported to us as of the dates indicated.

(20)Presents on a primary basis the total reported delinquent loans divided by the total PIF.

(21)Calculated by dividing total forbearances as reported by servicers by the total PIF.

The following table sets forth a reconciliation of net income to adjusted operating income for the three months ending March 31:

| (Amounts in thousands) | 2021 | 2020 | |||||||||

| Net Income | $ | 125,131 | $ | 145,265 | |||||||

| Adjustments to Net Income | |||||||||||

Net investment (gains) losses | 956 | (95) | |||||||||

Taxes on adjustments | (201) | 20 | |||||||||

Adjusted Operating Income (for the period ended) | $ | 125,886 | $ | 145,190 | |||||||

Economic Conditions

The United States economy and consumer confidence improved in the first quarter of 2021 compared to the fourth quarter of 2020 as state economies reopened in varying degrees; however, certain geographies and industries have experienced slower recoveries because of the virus, the mitigation steps taken to control its spread and changed consumer behavior. The unemployment rate was elevated at 6.0% in March 2021 compared to the pre-pandemic level of 3.5% in February 2020 but has decreased from a peak of 14.8% in April 2020. Even after the continued recovery in the first quarter of 2021, the number of unemployed Americans stands at approximately 10 million, which is 4 million higher than in February 2020. Among the unemployed, those on temporary layoff continued to decrease to 2 million from a peak of 18 million in April 2020, but the number of permanent job losses increased to approximately 3 million. In addition, the number of long term unemployed over 26 weeks increased to approximately 4 million. Specific to housing finance, mortgage origination activity remained robust in the first quarter of 2021 fueled by refinance activity and a strong surge in home sales. Refinance activity remained robust but relatively flat as compared to the fourth quarter of 2020. The purchase market

14

remained strong, but sales of previously owned homes decreased by 3.7% in the first two months of 2021 after reaching a post-2006 peak in the fourth quarter of 2020. Total unsold inventory of single-family homes remains low at 1.9 months of supply as of February 2021, which continues to drive home prices higher, increasing our average loan amount on NIW. While interest rates rose during the first quarter of 2021, they remained below levels in the first quarter of 2020 and served as an offset to rising prices in terms of affordability for borrowers. The pandemic continued to affect our financial results in the first quarter of 2021 but to a lesser extent than in the fourth quarter of 2020 as we experienced elevated, but declining, servicer reported forbearance and new delinquencies during the first quarter of 2021.

New insurance written

NIW of $24.9 billion in the first quarter of 2021 increased 39% compared to the first quarter of 2020 primarily due to higher mortgage purchase and refinancing originations and a larger private mortgage insurance market partially offset by our lower estimated market share in 2021. Our market share is influenced by the execution of our go to market strategy, including but not limited to, pricing competitiveness relative to our peers and our selective participation in forward commitment transactions. Our market share remains impacted by the negative ratings differential relative to our competitors, concerns expressed about our Parent’s financial condition and the execution of its strategic plans. We continue to manage the quality of new business through pricing and our underwriting guidelines, which we modify from time to time when circumstances warrant.

Insurance in-force, Risk in-force, and Persistency

IIF and RIF increased largely from NIW, offset by lapse as we experienced lower persistency in the first quarter of 2021. Primary persistency rate was 74% and 56% for the three months ended March 31, 2020 and 2021, respectively. Lower persistency has impacted business performance trends in several ways including, but not limited to, offsetting IIF growth from NIW, elevating single premium policy cancellations resulting in higher earned premiums, accelerating the amortization of our existing reinsurance transactions reducing their associated PMIERs capital credit in 2020 and shifting the concentration of primary IIF. For the three months ending March 31, 2021, our primary IIF has less than 10% concentration in 2014 and prior book years. Our 2005 through 2008 book year concentration is approximately 5%. In contrast, our 2020 book year represents 42% of our primary IIF concentration while our 2021 book year is 12% at March 31, 2021.

Net Premiums Earned

Net earned premiums increased in the first quarter of 2021 compared to the first quarter of 2020 primarily from growth in our IIF and from an increase in single premium policy cancellations driven largely by higher mortgage refinancing, partially offset by higher ceded premiums and lower average premium rates in the current year.

Loss Ratio

Our loss ratio for the three months ended March 31, 2021 was 22% as compared to 8% for the three months ended March 31, 2020. The increase was largely attributable to higher new delinquencies in the first quarter of 2021 primarily from an increase in borrower forbearance as a result of COVID-19. We also strengthened reserves on pre-COVID-19 delinquencies by $10 million during the first quarter of 2021 driven primarily by our expectation that pre-COVID-19 delinquencies will have a modestly higher claim rate than our prior best estimate given the slower emergence of cures to date. In addition, we experienced lower net benefits from cures and aging of existing delinquencies in the first quarter of 2021.

Delinquencies and Forbearances

Delinquent loans as compared to the same period in 2020 increased largely from significant new delinquencies as a result of COVID-19 offset by continued cure activity. The majority of new delinquencies since March 2020 have been subject to a borrower forbearance plan as a result of the

15

ongoing economic impact due to the pandemic. Approximately 54% of our primary new delinquencies in the first quarter of 2021 were subject to a forbearance plan as compared to less than 5% prior to the first quarter of 2020.

Servicer reported forbearance slowed meaningfully beginning in June 2020 and ended the first quarter of 2021 with approximately 4.9% of our active primary policies reported in a forbearance plan, of which approximately 64% were reported as delinquent. It is difficult to predict the future level of reported forbearance and how many of the policies in a forbearance plan that remain current on their monthly mortgage payment will go delinquent.

Expense Ratio

The expense ratio (net earned premiums) decreased primarily from higher net earned premiums, partially offset by higher operating costs in the current year.

Net Income and Adjusted Operating Income

Net income and adjusted operating income decreased primarily attributable to higher losses largely from new delinquencies driven in large part by a significant increase in borrower forbearance as a result of COVID-19, reserve strengthening of $8 million on pre-COVID-19 delinquencies and from lower net benefits from cures and aging of existing delinquencies in 2021. Additionally, the current quarter includes interest expense related to the 2025 Senior Notes offering, which occurred in August 2020. These decreases were partially offset by higher premiums largely driven by higher IIF and an increase in policy cancellations in our single premium mortgage insurance product primarily due to higher mortgage refinancing in 2021.

PMIERs